The world is becoming increasingly smaller (no new revelation there), and with this comes an opportunity for the tech world to reach more customers, more talent, and more investors… remotely, of course.

Over the last year, we’ve seen more funding in Europe than ever before, with $36b in total deals from the Venture community. The markets break down into Eastern, Western and Northern Europe with $2.48B, $14.93B and $18.63B respectively, showing year over year growth of 25%. The landscape there is changing at pace and for those clued in, it could be the best decision you make.

We sat down with Ales Mika from DEPO Ventures, an early-stage firm based in the heart of Prague, Czech Republic, they have a seed investment fund, a network of business angels and provide M&A advisory services for early-stage companies.

Ales is the Principal and Head of Advisory, growing up in the United States, Ales relocated to be in Prague, moving from M&A to early-stage investing, he’s seen all aspects, opinions, and cultures across the two continents. We wanted to understand what it means to look to Europe as a platform for investment and shed some light on the scene.

As a European VC who has close ties to the US, what do you think the key differences are in the mindset of investors?

On a broad level, I think the mindset difference stems from the differences in business cultures, formalities and risk appetites. This then trickles down, all the way down to the Angel level. In general, European VCs would be slightly more risk-averse in building up their startup portfolio. They might focus more on the ultimate exit strategy rather than exiting, at the right time.

Do you think it is a lack of entrepreneurs in Europe, the ‘education’ for startups or the lack of venture capital? Or is it something else that keeps Europe behind?

First, you have to understand that Europe is fragmented into numerous sovereign countries and markets. Yes, being in the European Union helps, but still, you have different languages, cultures and laws. To answer the questions above you have to focus on the specific market. The UK is most similar to the US, which helps those coming over, but it is a small market overall. Travel an hour to a very different country like Germany which has a different dynamic too even internally, with their Idea hub (Berlin) and their investment hub (Munich) both places having very different mindsets and functions.

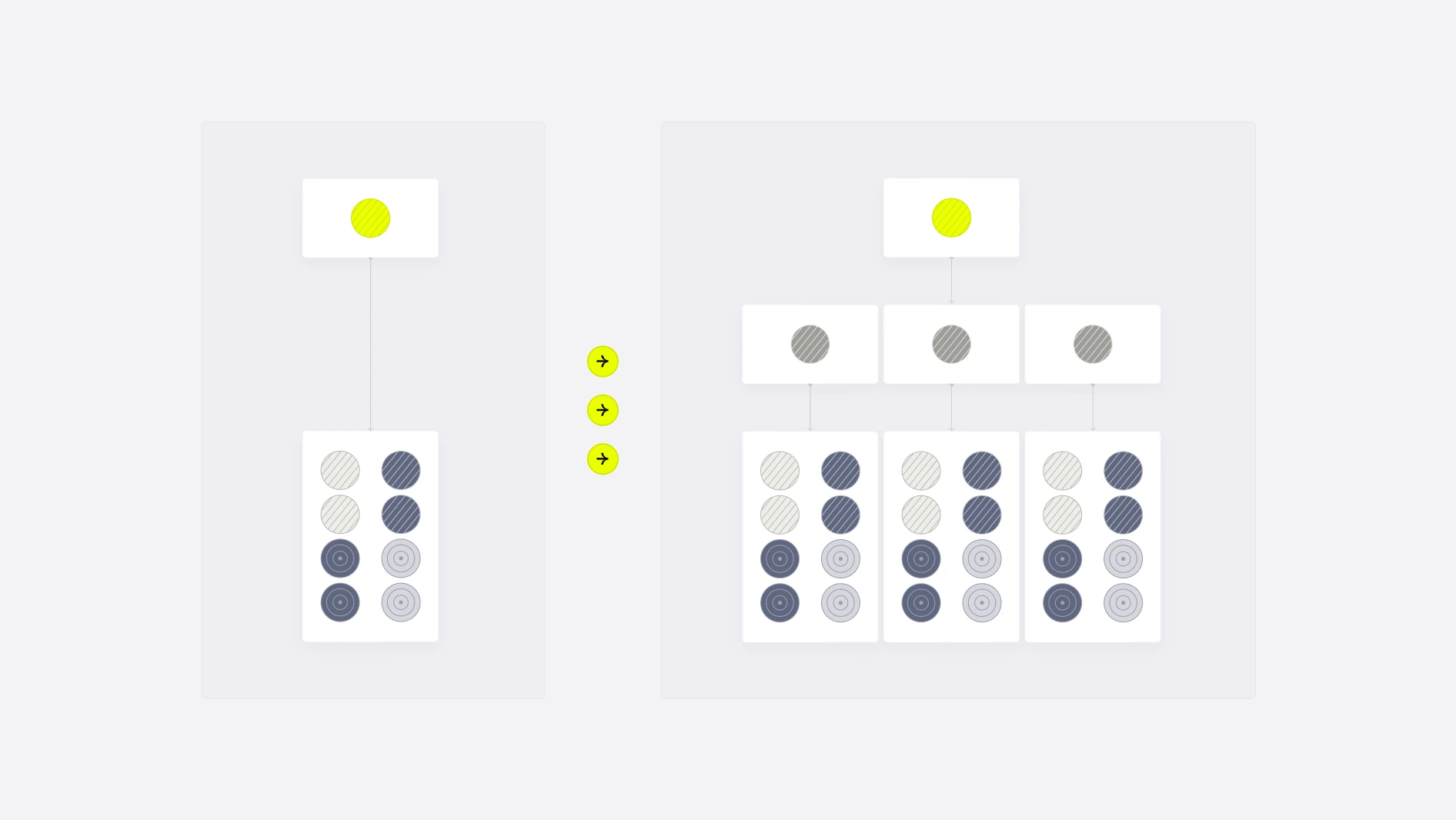

When focusing on the Czech Republic I would say that the lack of “well-educated” business angels is a problem over here, something that we are trying to change. Looking at a grassroots style of investing, it is not as common for angels to understand the potential, as they haven’t done it themselves.

What are VC’s doing to try and improve the ecosystem and catch up with the US?

Speaking for DEPO Ventures, we try to focus on the grassroots pre-seed projects via our Grouport fund. Finding an investor when you’re already generating 30k EUR monthly is not that hard to do. But getting there is tricky, we encourage startups to think globally from the get-go.

To the region, this style of investment is relatively new, compared to Series A and beyond firms that are known such as Rockaway and Credo ventures. As this is tried and tested, therefore trusted by the more conservative investors.

We know that lots of Europeans look to the US for funds, but have you seen a trend in American founders coming over here recently?

Yes, there is an increasing trend, as the traditional hubs get saturated with deal flow, it becomes overwhelming and people look to break away. It’s still not that often but US startups also realize that if they want to expand to Europe having a European Strategic Investor on board is a big plus.

They will share cultural, local and business knowledge with the founders, something it would otherwise take a long time to grasp.

Why should a Startup come over to Europe for funding?

Obtaining a strategic Investor that will help with the local environment, local contacts, and network, to establish a strong foothold. We have some excellent institutions that would love to see the varied deals on offer as It can also boost our learnings and what we can share across the portfolio.

Any key advice for US startups coming over here to raise?

I’ve seen US startups pitch over here without having a European go-to-market strategy. They just presented their US-focused pitch decks. Yes, making money in the US is great but EU VCs want to see how you plan to launch your business over here.

So if you are looking to come to Europe for funding, it is a culturally vast space and your strategic investors can open up an entirely new market for your company, just remember to do your research.

Thank you to Ales for opening this topic into the European ecosystem.