The Problem

1.7 billion people, or a fifth of the world’s population, don’t have a bank account. That means the services we often take for granted like taking out a loan or mortgage; sending money abroad to our friends and family; or even being paid a salary into our account, aren’t available to these people. As you can see from the illustration below, the majority of these 1.7 billion adults live in developing nations, with women being an overrepresented segment of the ‘unbanked’ population. But why are financial inclusion and access to formal financial services critical problems to solve?

As World Bank Group President Jim Yong Kim states,

“Financial inclusion allows people to save for family needs, borrow to support a business, or build a cushion against an emergency. Having access to financial services is a critical step towards reducing both poverty and inequality.”

When we factor this in with the point that reducing poverty is the number 1 priority laid out in the UN’s Sustainable Development Goals, it is evident that efforts to increase bank account ownership and financial inclusion are critical to reducing worldwide poverty and increasing quality of life, whilst also ensuring we continue to reduce gender inequality.

Why Solve It?

Of course, I don’t expect the private sector to pile in and begin solving this problem without a clear financial and economic reason to do so, but I think even this lens provides a compelling reason to enter the market.

I like to use YC Partner Kevin Hale’s framework for analysing a problem and its potential viability as a start-up idea. His framework is broadly focused on the following questions:

- Is it a popular problem?

- Is it a frequently experienced problem?

- Is it a mandatory problem to solve?

Firstly, it is evident from the numbers above that the problem is certainly a popular one, with 1.7 billion people worldwide currently without a bank account. Whilst we could get seriously deep into the numbers to work out our specific target customers and the Life Time Value (LTV) for each of those target customers to work out an exact figure, I think it is a reasonable conclusion to state that this is an incredibly popular globally dispersed problem.

In terms of frequency, I calculated that on average I interact with my financial services products around 10–20 times per day. Whilst the frequency will be lower for the unbanked who do not yet have access to digital services, we can reasonably assume they will be paying for things on a daily basis, often with more friction and pain, meaning it is a problem experienced daily for them.

As stated above, the problem is a huge inhibitor to escaping poverty, building assets, and cushioning against emergencies. This, coupled with a gradual decline in the number of economies using high-denomination currencies, are all solid reasons for why it is absolutely a mandatory problem to solve to reduce the impact on the poor and continue to increase the quality of life for everyone on the planet.

Why Now?

Whilst assessing the market size and problem are all critical before entering the market, timing is just as important and I believe we are at a significant juncture that presents an excellent opportunity for FinTech.

One significant headwind to new FinTechs entering the market previously has been a lack of infrastructure. Many of the ‘unbanked’ around the world live in extremely rural or remote locations where they lack basic infrastructures such as telephone signal, internet connectivity, or a mobile phone. This has presented high barriers to entry for potential FinTechs looking to disrupt the market. However, new data from the World Bank suggests this is now changing.

As Jim Yong Kim states,

“New data on mobile phone ownership and internet access show unprecedented opportunities to use technology to achieve universal financial inclusion.”

An acceleration in global smartphone penetration has meant that two-thirds of unbanked adults now own a mobile phone, or around 1.1 billion ‘unbanked’ adults globally. This means two-thirds of the world’s ‘unbanked’ now have the ability to access formal financial services, presenting an excellent opportunity for governments and the private sector to build products and services that bring the ‘unbanked’ into the financial services ecosystem. In other words, the barriers to new low-cost, high-tech financial services have fallen dramatically.

The Market Opportunity

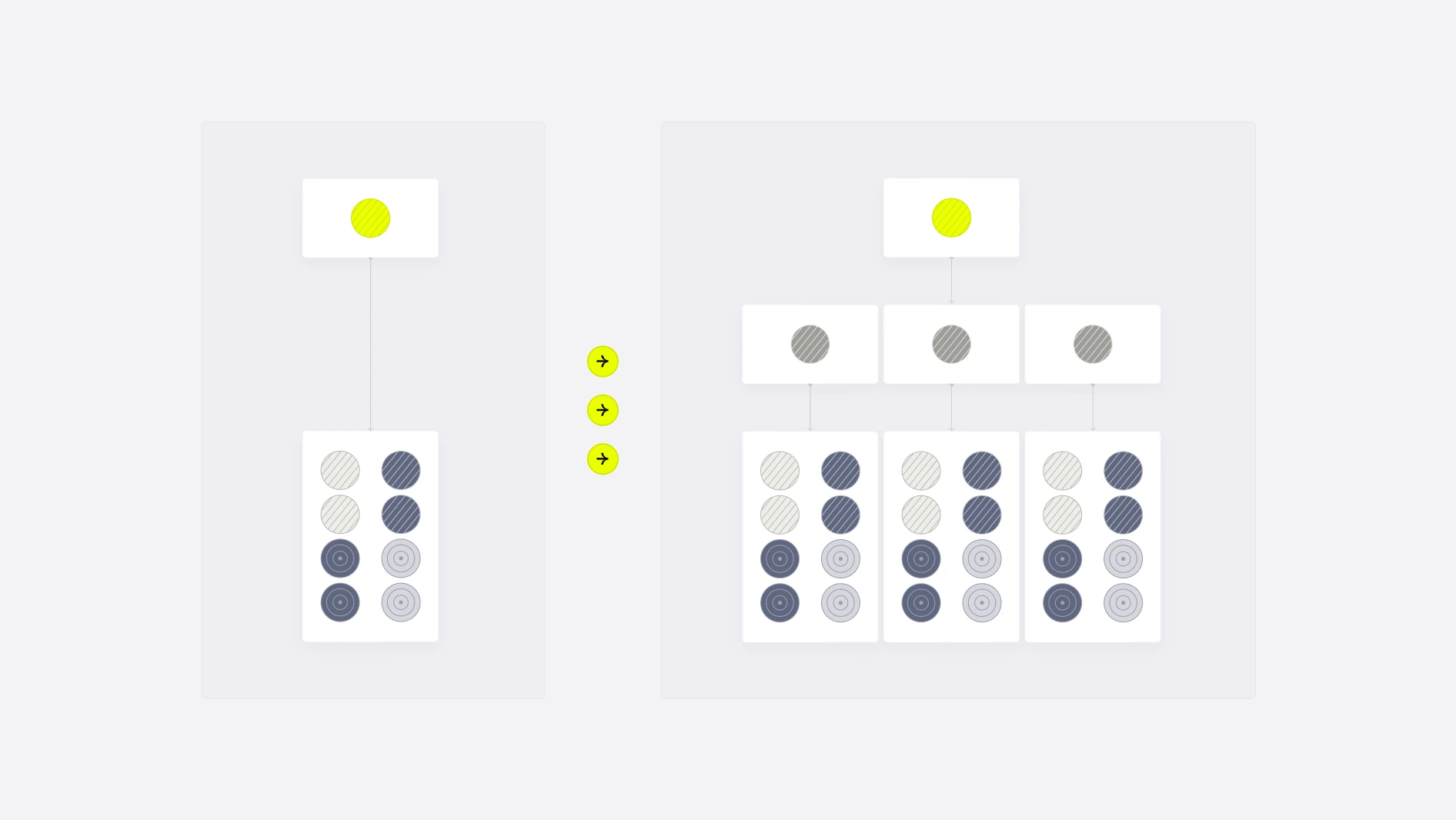

FinTech is able to make financial services more accessible to a growing number of people throughout the world. However, there are a number of areas to play in this market and all are important links for ensuring a successful and efficient ecosystem emerges. Areas include the following:

- Infrastructure and hardware

- Customer identification services

- Digital banking

- Payments

- International money remittance

- Financial literacy and education

- Regulation

- Enterprise software (SaaS)

- Credit & borrowing

Current State Of The Market

Below is a current view of the market as it stands. Whilst this is not a complete view, I have tried to apply some logic to the groupings by selecting companies that are actively engaged, either directly or indirectly, in helping the ‘unbanked’, or simply operate in developing nations.

References

- https://globalfindex.worldbank.org/

- https://www.worldbank.org/en/news/press-release/2018/04/19/financial-inclusion-on-the-rise-but-gaps-remain-global-findex-database-shows

- https://www2.deloitte.com/lu/en/pages/technology/articles/regtech-companies-compliance.html

- https://www.weforum.org/agenda/2020/08/financial-inclusion-fintech-underbanked-technology/